Digital cash principle and application – Imagine a globe where you can send out cash around the world quickly, without the demand for financial institutions or difficult documents. This is the assurance of electronic cash, an advanced principle changing exactly how we think of and utilize money. From daily purchases to complicated worldwide profession, electronic cash is swiftly improving monetary landscapes. This interesting brand-new frontier uses extraordinary chances, however additionally elevates vital factors to consider concerning access, law, and protection.

Digital cash includes a variety of applications and innovations. It consists of whatever from cryptocurrencies like Bitcoin and Ethereum to mobile repayment systems like Apple Pay and Google Pay. These systems use rate and comfort that standard approaches just can not match. Consider the simplicity of sending out cash to a pal or relative in a various nation, or spending for products and solutions with simply a faucet on your phone. These applications are not practically comfort; they have to do with empowerment and monetary incorporation, specifically for those in underserved neighborhoods.

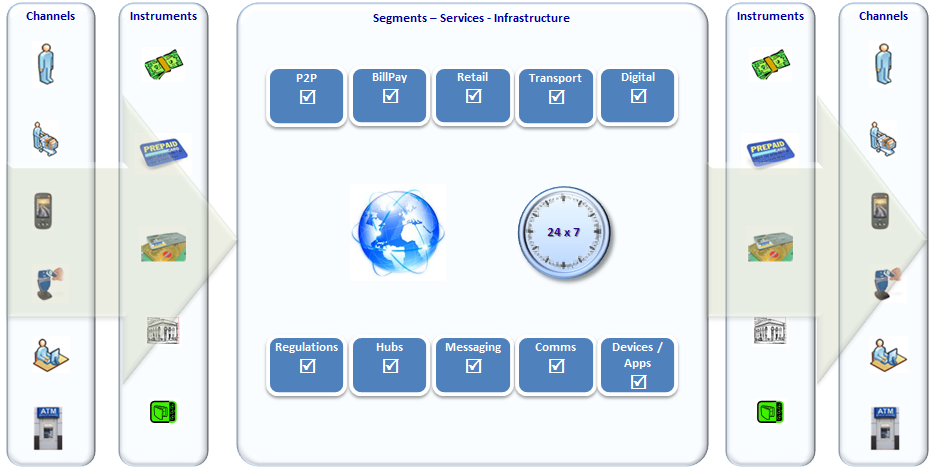

Key applications of electronic cash are many and continuously developing. They vary from:

- Microtransactions: Facilitating tiny, constant settlements, like on the internet memberships or in-app acquisitions.

- Peer-to-peer (P2P) settlements: Allowing people to obtain and send out cash straight without middlemans.

- Cross-border compensations: Streamlining the procedure of sending out cash worldwide at substantially reduced prices.

- Investment and trading: Providing accessibility to international monetary markets via electronic systems.

Security is a critical worry in the electronic cash room. The surge of advanced cyber risks needs durable protection steps to secure customer funds and individual info. Executing file encryption, multi-factor verification, and safe and secure deal procedures is vital to constructing trust fund and self-confidence in these systems. The regulative landscape bordering electronic cash is still developing, developing a requirement for clear standards and policies to make certain moral and liable usage.

Famous entities like PayPal, Square, and also significant financial institutions are proactively associated with establishing and carrying out electronic repayment systems. This extensive fostering highlights the substantial possibility of electronic cash to improve the international monetary system. The recurring advancement of blockchain innovation, specifically, is leading the way for a lot more cutting-edge applications, consisting of decentralized financing (DeFi) and non-fungible symbols (NFTs). These growths assure to reinvent exactly how we communicate with cash and worth in the electronic age. By cultivating technology and attending to protection worries, we can open the complete possibility of electronic cash to develop a much more reliable and comprehensive monetary future.